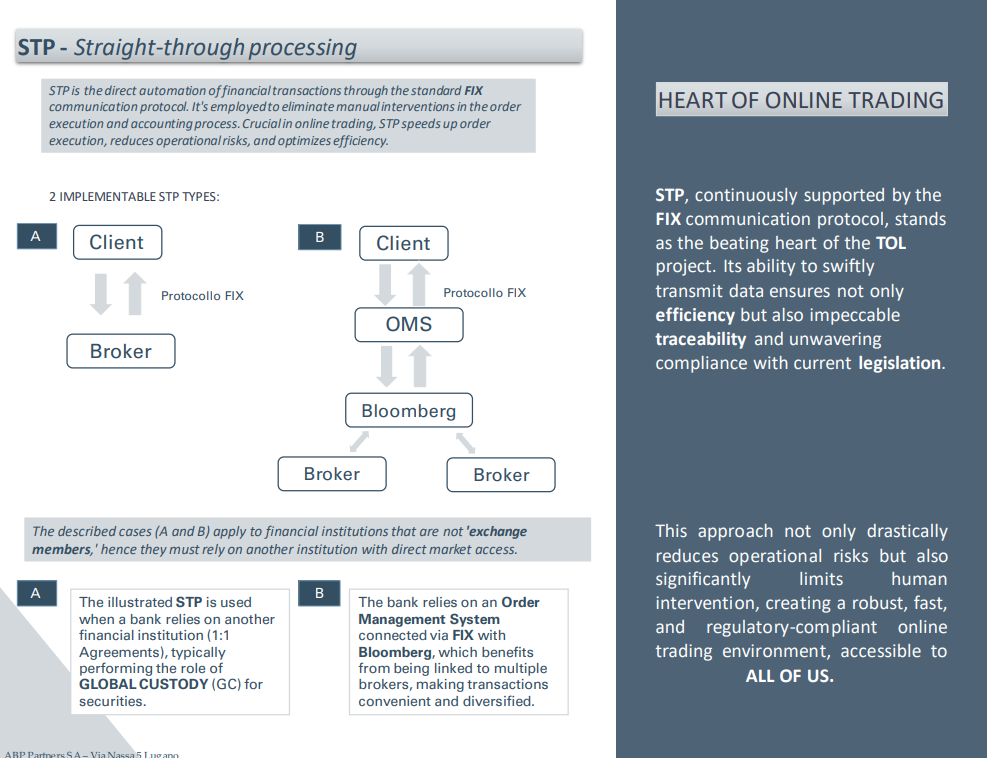

Addressing banks and financial institutions, we have developed a system that offers an intuitive and reliable user experience. By utilizing Straight Through Processing (STP) technology, we ensure swift and secure executions while strictly adhering to continuously evolving global financial regulations.

Our platform is designed to adapt to the ever-changing legal landscape, ensuring not only superior returns but also peace of mind in a complex regulatory environment.

Key features of our solution include:

I) Expanded investable universe: stocks, ETFs, funds, bonds, derivatives, and structured instruments integrated with informative data streams via Telekurs.

II) Document and regulatory flow: stock information management, printing, and document storage.

III) 24/7 operability: continuous access to markets, especially for US and Western markets, enabling order management at any time.

IV) Draft orders: ability to create preliminary orders for further review and confirmation.

V) STP and NON-STP order management: immediate client communication at the time of order, with partial or total cancellation options using restrictions such as market, limit, stop loss, and stop limit.

Trading Online

VI) Fund approval: Approval of funds for order execution. VII) Trustee controls: compliance with trustee regulations, including suitability and applicability criteria for regulated clients.

VIII) PRIIP regulations compliance: inclusive of PRIIP and KID regulations for maximum transparency and client protection.

IX) Support integration: continuous assistance from the trading floor, back office, and technical support, even on holidays.

X) Order automation: utilization of the FIX messaging protocol integrated with the reference broker for effective order automation.

XI) Widget visualization: access to information on all global securities 24/7 via an external provider.

XII) Detailed reporting: provision of comprehensive reports to clients on all order executions, including partial ones, with execution price indication.

XIII) Trading requirements management: handling of minimum size, round lot, and tick size requirements to ensure efficient and compliant trading.

XIV) Client risk profile management: Customization of risk profiles for clients enabled for online trading.

For further information, please contact: